Insurance in and around Edmond

Protect the life you've built

Protect what matters most

Would you like to create a personalized quote?

Personal Price Plans To Fit Your Needs

Everyone loves saving money. Design a coverage plan that helps protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, you can create a plan that’s right for you. Contact Thomas Webber for a Personalized Price Plan.

Protect the life you've built

Protect what matters most

Got An Objective In Mind? Let Us Help You Get There

Want to know why State Farm is the largest insurer of automobiles and homes in the U.S.? Great insurance coverage options, competitive prices, easy claims and excellent service might have a lot to do with it. Or maybe you're looking to help secure your family's financial future. Let us help you ease that burden. The unmatched strength of State Farm Life Insurance, a wide range of products and Personalized Price Plans; it's a great value and smart choice.

Simple Insights®

Why attic ventilation matters

Why attic ventilation matters

Proper attic ventilation is important, especially for homes located in climates where snow, ice dams and humidity problems are common.

Help make your commute safe and sane

Help make your commute safe and sane

Want a safer commute? There are things you can do to help make sure you commute safely, such as eliminating distractions. Read these tips from State Farm.

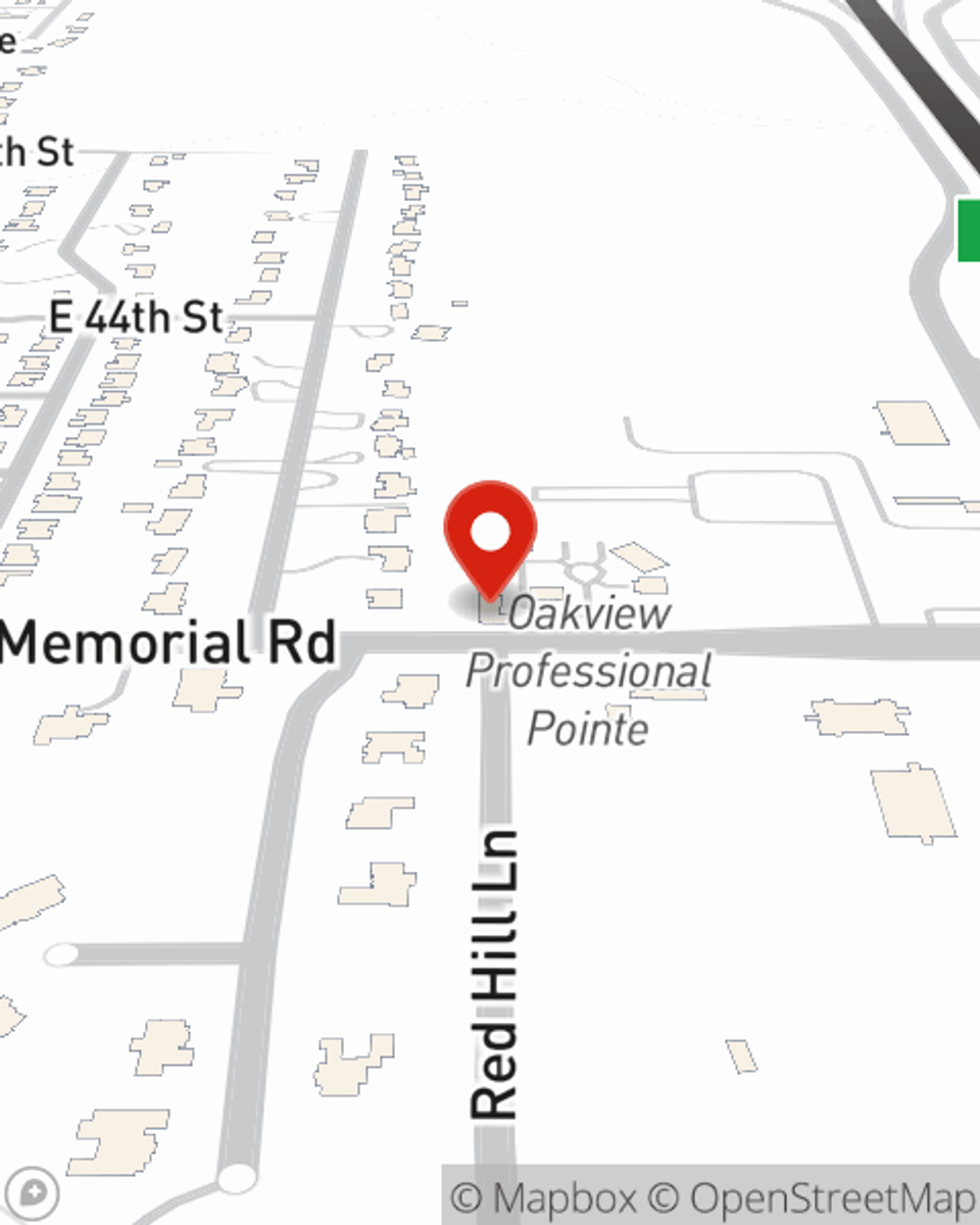

Thomas Webber

State Farm® Insurance AgentSimple Insights®

Why attic ventilation matters

Why attic ventilation matters

Proper attic ventilation is important, especially for homes located in climates where snow, ice dams and humidity problems are common.

Help make your commute safe and sane

Help make your commute safe and sane

Want a safer commute? There are things you can do to help make sure you commute safely, such as eliminating distractions. Read these tips from State Farm.